#TechnologyNews #Facebook Inc:Profits of $2.53 per share anticipated for fourth quarter #BB

„Facebook Inc:Profits of $2.53 per share anticipated for fourth quarter

„

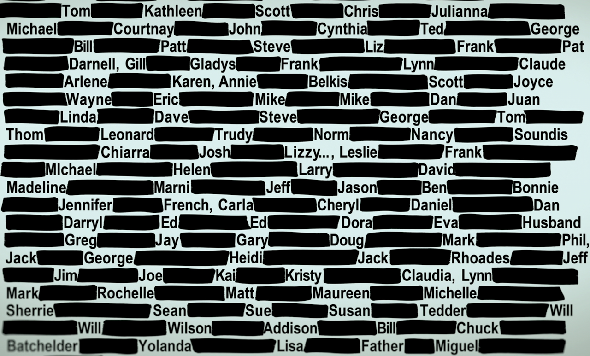

RECOMMENDATIONS * The consensus recommendation for the company is „Buy“. This includes eighteen „Strong Buy“, thirty „Buy“, three „Hold“, two „Sell“. * The average consensus recommendation for the online services peer group is also „Buy“.

FORECAST CHANGES * Forty seven analysts are currently providing Refinitiv with estimates. * In the last week one analyst has negatively revised an earnings estimate and three analysts have revised earnings estimates upward. There were no changes to the number of estimates. * In the last four weeks the earnings per share estimate has risen by 0.13 percent from $2.52. Estimates ranged from a high of $2.78 to a low of $2.04. There has been no changes to the number of estimates. * The StarMine predicted earnings surprise is is too low to be considered statistically significant. Predicted revenue surprise is too low to be significant. * The average price target from the forty seven analysts providing estimates is $248.83.

YEAR OVER YEAR * The company is expected to report a rise in revenue to $20.89 billion from $16.91 billion in the same quarter last year. * The current quarter consensus estimate of $2.53 per share implies a gain of 6.12 percent from the same quarter last year when the company reported $2.38 per share.

If you want to read more Technology articles, you can visit our Technology category.

if you want to watch movies go to Film.BuradaBiliyorum.Com for Tv Shows Dizi.BuradaBiliyorum.Com, for forums sites go to Forum.BuradaBiliyorum.Com .